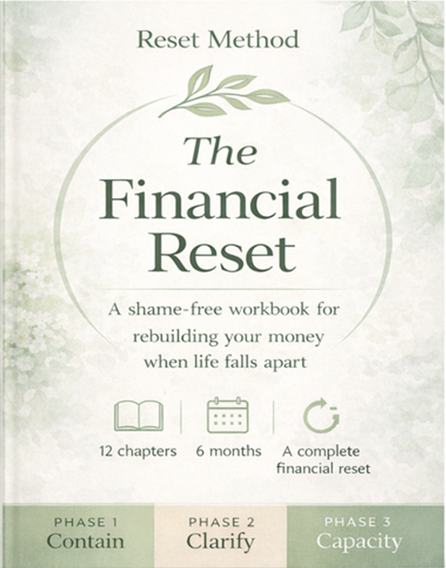

The Financial Reset

This is not about becoming "good with money." This is not about following rules someone else made, pretending you care about spreadsheets, or feeling shame about where you are.

This is about seeing clearly and acting strategically — from exactly where you stand right now.

This isn't about budgeting harder.

-

Shame-Free

A shame-free workbookfor rebuilding your money when life falls apart

-

Your Capacity, Your System

It's about facing your financial reality without spiraling, building stability without shame, and creating a system that works with your actual capacity -not against it.

-

The full journey

12 chapters. 6 months. A complete financial reset.

✺ Frequently asked questions ✺

-

This workbook isn't about being "good with numbers" — it's about facing your real situation without shame and building a system that actually works for your life. There's no complicated math. The exercises guide you step-by-step, and the Excel toolkit does the calculations for you. If you can write down what you spend and what you earn, you can do this.

-

Most financial programs assume you have energy, stability, and motivation you don't have right now. The Financial Reset uses capacity-based budgeting — meaning your budget flexes based on whether you're having a high, medium, or low capacity day. It also addresses the emotional side: the shame, the avoidance, the spiral. This isn't about perfect spreadsheets. It's about sustainable money habits during a hard season of life.

-

The program is designed for 6 months, but you work at your own pace. Each chapter takes 30-60 minutes to complete. Some women do one chapter per week; others take longer. There's no deadline, no falling behind. The worksheets wait for you — even if you need to pause and come back.

-

This workbook was created specifically for women whose finances have fallen apart — after divorce, job loss, illness, or major life change. Chapter 1 starts with "Money Spiral vs. Reality" because I know you might be avoiding looking at the numbers. We go gently, one truth at a time. Bad situations don't disqualify you. They're exactly why this exists.

-

The PDF workbook is the complete program — all 12 chapters, exercises, and reflection prompts. You can absolutely use it on its own with pen and paper. The Excel toolkit is optional but helpful: it automates your budget calculations, tracks debt payoff, and shows your progress visually. If spreadsheets stress you out, skip it. If they help you feel in control, add it.

-

You didn't fail — the system failed you. Traditional budgets don't account for emotional spending, capacity fluctuations, or the reality of rebuilding after crisis. This program has built-in "re-entry without shame" — meaning when you fall off (and you will, we all do), there's a clear path back. No starting over. No guilt. Just picking up where you are.